The Benefits of Using a Mutual Fund App

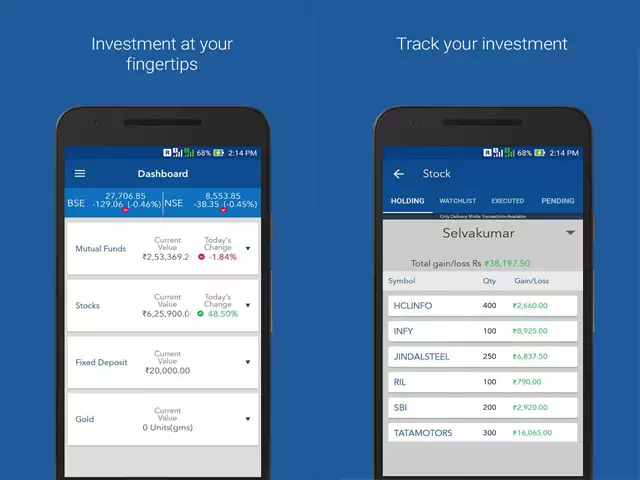

Mutual fund apps offer investors a convenient and user-friendly way to manage their investment portfolios. With just a few taps on their smartphones, users can access real-time updates on their investments, make transactions, and monitor their performance effortlessly. This level of accessibility allows investors to stay informed and engaged with their financial goals at all times, without the need to rely on traditional methods of managing investments.

Moreover, mutual fund apps often provide a wide range of investment options, allowing users to diversify their portfolios easily. Through these apps, investors can explore different asset classes, sectors, and geographic regions, thereby reducing risk and increasing potential returns. The intuitive interfaces of mutual fund apps make it simple for even novice investors to build a diversified portfolio tailored to their risk tolerance and financial objectives.

Understanding the Importance of Diversification in Investment

Diversification is a fundamental principle in investment that involves spreading your money across a variety of assets. By diversifying your portfolio, you can reduce the overall risk of your investments. Putting all your money into just one type of investment can leave you vulnerable to market volatility.

Investing in a diverse range of assets, such as stocks, bonds, and real estate, can help you achieve a more balanced portfolio. Each asset class has its own unique risk and return characteristics, so by diversifying, you can potentially minimize losses in one area while benefiting from gains in another. It’s important to note that diversification does not completely eliminate risk, but it can help you manage and mitigate it effectively.

Understanding the Importance of Diversification in Investment Diversification is a fundamental principle in investment that involves spreading your money across a variety of assets. By diversifying your portfolio, you can reduce the overall risk of your investments. Putting all your money into just one type of investment can leave you vulnerable to market volatility. Investing in a diverse range of assets, such as stocks, bonds, and real estate, can help you achieve a more balanced portfolio. Each asset class has Share Broker its own unique risk and return characteristics, so by diversifying, you can potentially minimize losses in one area while benefiting from gains in another. It’s important to note that diversification does not completely eliminate risk, but it can help you manage and mitigate it effectively.

How to Choose the Right Mutual Fund App for Your Needs

When selecting a mutual fund app that aligns with your investment goals and preferences, it is essential to consider the platform’s user interface and overall ease of use. A user-friendly interface can significantly enhance your experience by providing easy navigation, clear information display, and intuitive features that simplify the investment process. Look for apps that offer a clean and organized layout, making it convenient for you to monitor your investments, make transactions, and access relevant resources with minimal effort.

Furthermore, it is crucial to assess the range of mutual funds available on the app and ensure that they match your risk tolerance, investment horizon, and financial objectives. Consider apps that provide a diverse selection of mutual funds across various asset classes, sectors, and regions to create a well-rounded and balanced investment portfolio. Additionally, check if the app offers tools or resources that can help you analyze and compare different funds, understand their performance metrics, and make informed investment decisions based on your individual financial situation and goals.

The Role of Technology in Simplifying Investment Processes

Technology has played a pivotal role in simplifying investment processes in recent years. With the advent of various digital platforms and apps, investors now have greater access to information, tools, and resources to make informed decisions. These technological advancements have made it easier for individuals to research investment opportunities, track their portfolios, and execute trades efficiently.

Moreover, the integration of artificial intelligence and machine learning algorithms in investment platforms has enhanced the overall user experience by providing personalized insights and recommendations based on individual preferences and risk profiles. These technologies analyze vast amounts of data in real-time, helping investors stay informed about market trends and make timely decisions. As a result, technology has not only simplified investment processes but also empowered investors to take control of their financial futures with greater ease and confidence.

The Advantages of Investing in Mutual Funds through an App

Investing in mutual funds through an app provides convenience and accessibility to investors. With just a few taps on their smartphones, investors can easily browse through a wide range of mutual fund options, compare performance metrics, and make investment decisions instantly. This real-time access to information and transactions eliminates the need for traditional paperwork and in-person visits to financial institutions, making the investment process more efficient and user-friendly.

Moreover, mutual fund apps often come equipped with tools and resources that help investors make informed decisions. These apps may offer personalized recommendations based on individual financial goals and risk tolerance, as well as educational materials to enhance investors’ understanding of the market. By leveraging the technology and features available on these apps, investors can streamline their investment strategies and potentially maximize returns in the long run.

Tips for Maximizing Returns on Your Investments through an App

When it comes to maximizing returns on your investments through a mutual fund app, one key tip is to regularly review and rebalance your portfolio. Monitoring the performance of your investments and making adjustments as needed can help ensure that your portfolio remains aligned with your financial goals and risk tolerance. By periodically reassessing your asset allocation and making strategic changes, you can potentially enhance your overall returns over time.

Another important tip for maximizing returns on your investments through a mutual fund app is to take advantage of dollar-cost averaging. By investing a fixed amount of money at regular intervals, regardless of market conditions, you can avoid the pitfalls of trying to time the market. This disciplined approach can help smooth out the effects of market volatility and potentially lead to better long-term investment results. By automating your investment contributions through the app, you can benefit from this strategy with minimal effort.

When it comes to maximizing returns on your investments through a mutual fund app, one key tip is to regularly review and rebalance your portfolio. Monitoring the performance of your investments and making adjustments as needed can help ensure that your portfolio remains aligned with your financial goals and risk tolerance. By periodically reassessing your asset allocation and making strategic changes, you can potentially enhance your overall returns over time. Another important tip for maximizing returns on your investments through a mutual fund app is to take advantage of dollar-cost averaging. By investing a fixed amount of money at regular intervals, regardless of market conditions, you can avoid the pitfalls of trying to time the market. This disciplined approach can help smooth out the effects of market volatility and potentially lead to better long-term investment results. By automating your investment contributions through the app, you can benefit from this strategy with minimal effort.

The Risks Associated with Investing in Mutual Funds through an App

Investing in mutual funds through an app can expose investors to certain risks that should be carefully considered. One primary risk is the potential for technical glitches or malfunctions within the app itself, which could lead to delays in executing trades or accessing vital account information. Such technological issues could impact the timely management of your investments and may result in missed opportunities or losses.

Furthermore, the convenience of investing through an app can sometimes be a double-edged sword. The ease of access and simplicity of making transactions at any time may tempt investors to engage in frequent buying or selling without thorough research or a solid investment strategy. This impulsive behavior could lead to poor decision-making and potential losses, as emotional trading can be detrimental to long-term investment success.

How to Monitor and Track Your Investments Effectively

Monitoring and tracking your investments is essential to ensure they align with your financial goals. One way to effectively keep tabs on your investments is to set up regular check-ins, whether it’s on a daily, weekly, or monthly basis. By staying proactive in monitoring your portfolio, you can make informed decisions based on market trends and adjust your investment strategy accordingly.

Utilizing the features of a mutual fund app can streamline the monitoring process, providing real-time updates on your investments. Accessing performance reports, portfolio summaries, and transaction history through the app allows for convenient tracking of your investments’ progress. Additionally, setting up alerts and notifications can help you stay informed about any significant changes, empowering you to take timely actions to protect and maximize your investments.

The Future of Investing: The Rise of Mutual Fund Apps

The rising popularity of mutual fund apps is indicative of a shifting investment landscape toward greater accessibility and user-friendly platforms. These apps have democratized investing by providing individuals with convenient tools to manage their funds at their fingertips, eliminating barriers to entry that were once prevalent in the financial world. With the convenience of round-the-clock access, users can now make informed investment decisions on their own terms, without the need for intermediaries or extensive financial knowledge.

As technology continues to advance, mutual fund apps are expected to further revolutionize the investment landscape, making it easier for individuals to diversify their portfolios and monitor their investments in real-time. The rise of these apps signifies a trend towards self-directed investing, empowering users to take control of their financial futures with greater ease and efficiency. As more investors embrace these digital platforms, the future of investing is likely to become increasingly intertwined with the use of mutual fund apps as a key tool for wealth creation and financial management.

The rising popularity of mutual fund apps is indicative of a shifting investment landscape toward greater accessibility and user-friendly platforms. These apps have democratized investing by providing individuals with convenient tools to manage their funds at their fingertips, eliminating barriers to entry that were once prevalent in the financial world. With the convenience of round-the-clock access, users can now make informed investment decisions on their own terms, without the need for intermediaries or extensive financial knowledge. As technology continues to advance, mutual fund apps are expected to further revolutionize the investment landscape, making it easier for individuals to diversify their portfolios and monitor their investments in real-time. The rise of these apps signifies a trend towards self-directed investing, empowering users to take control of their financial futures with greater ease and efficiency. As more investors embrace these digital platforms, the future of investing is likely to become increasingly intertwined with the use of mutual funds sip app as a key tool for wealth creation and financial management.

Key Considerations Before Getting Started with a Mutual Fund App

Before diving into the world of mutual fund apps, it is crucial to assess your financial goals and risk tolerance. Understanding your investment objectives will help you select the right mutual fund app that aligns with your needs. Consider whether you are investing for short-term gains, long-term wealth accumulation, or retirement planning. Additionally, evaluate your comfort level with risk to determine the most suitable investment strategy for your unique situation.

Another key consideration before getting started with a mutual fund app is to research and compare different apps available in the market. Look into factors such as user-friendliness, fees and expenses, investment options, customer support, and security measures. Reading reviews and seeking recommendations from trusted sources can provide valuable insights into the reliability and performance of various mutual fund apps. By conducting thorough research, you can make an informed decision and set yourself up for a successful investment journey using a mutual fund app.